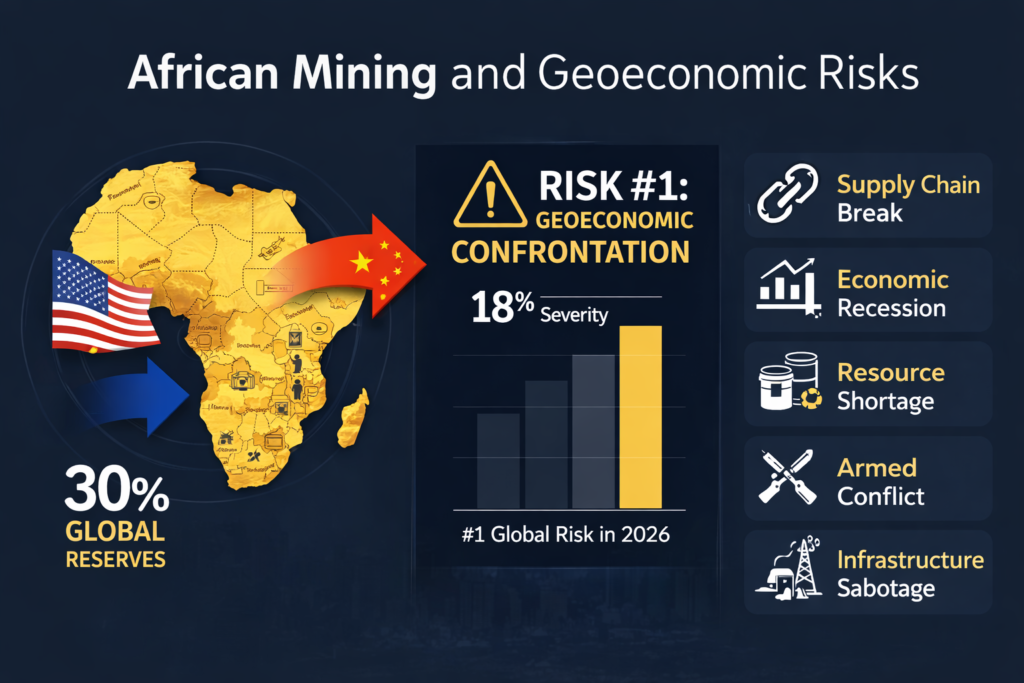

The era of “market-first” mining is dead. According to the World Economic Forum’s Global Risks Report 2026, released just weeks ago, geoeconomic confrontation has officially become the world’s #1 immediate threat. For the first time in 21 years, the weaponization of trade, tariffs, sanctions, and export bans outranks armed conflict as the most likely trigger for a global crisis.

The Weaponization of the Periodic Table

The report confirms a “paradigm shift”: critical minerals are now geopolitical influence weapons. China’s recent export controls on antimony and gallium, paired with the U.S. “Day One” executive orders to dominate non-fuel mineral processing, have left African producers caught in the middle.

Countries not aligned with China or the United States may face pressure to comply with sanction regimes.

The 2026 Global Risks Report

Key players in Africa’s mining sector are no longer just discussing extraction; they are navigating a world where a shipment of cobalt or lithium is a move on a global chessboard.

The numbers are stark:

80% to 90% of global refining for cobalt and rare earths remains concentrated in China.

18% of global experts now view supply chain fragmentation as a systemic threat to 2026 growth.

$170 billion: The amount China has poured into African infrastructure since 2000, creating a “debt-and-dependency” trap that Western initiatives like the Global Gateway are now desperately trying to counter.

Neutrality is Getting Expensive

For the mining sector, the “balancing act” is reaching a breaking point. Countries like the DRC and Zambia are facing intense pressure to pick a side. However, a new African narrative is emerging: “Strategic Autonomy.” “Africa is no longer a passive supplier,” emphasize experts. The goal is to move from “volume-led growth” to “value-led growth.”

By leveraging the current scarcity, African nations are demanding local refineries and processing plants as the price of entry for foreign investors.

The Militarization of Logistics

The 2026 risk map highlights a terrifying new frontier: the physical disruption of infrastructure. From sabotaged undersea cables to blocked maritime straits, the corridors carrying Africa’s wealth are increasingly vulnerable.

Projects like the Lobito Corridor are seen as vital, but they also represent high-value targets in a fragmented world order where 68% of leaders expect a multipolar system governed by “realpolitik” rather than international law.

The 2026 Risk Interconnection

Supply chain disruption is now ranked as the world’s 19th most severe global risk, underscoring growing vulnerabilities in an increasingly fragmented economic order. At the same time, resource nationalism is on the rise, as states move to build “strategic reserves” and tighten control over critical raw materials.

Across Africa, a harsh economic reckoning is unfolding: high debt levels and persistent inflation are forcing governments to sell stakes in mining assets, sometimes back to national authorities themselves, not as a strategic choice, but as a fiscal survival mechanism that risks undermining long-term sovereignty.

In 2026, a mine is no longer just an investment; it’s a fortress. Africa holds the keys to the green transition, but without a unified strategy, it risks being the arena where major powers settle their scores.