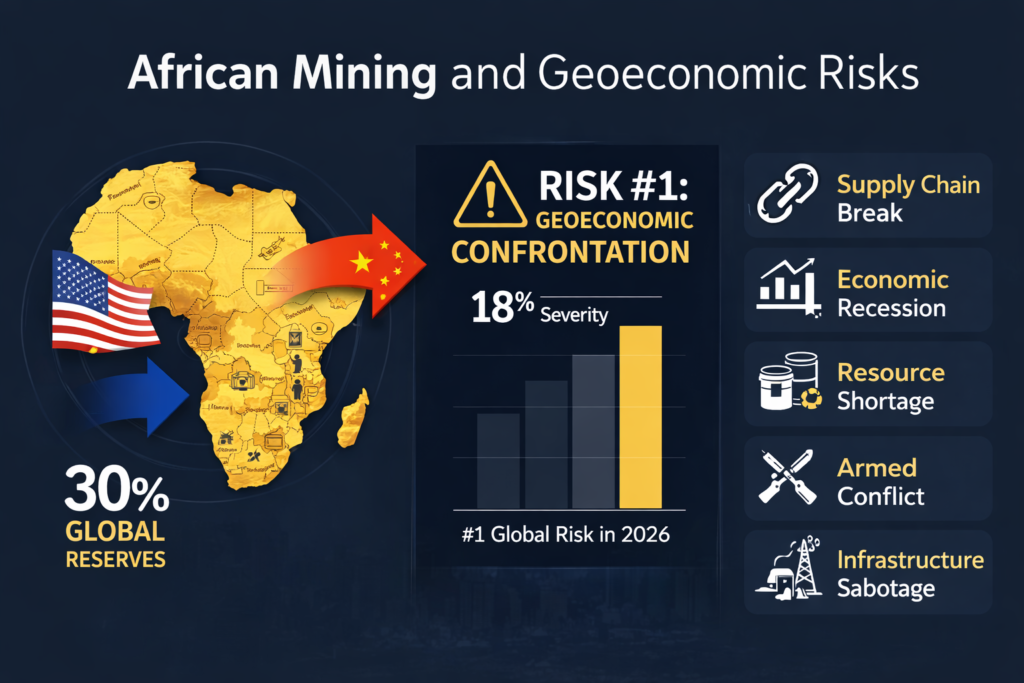

For the first time since the launch of the Global Risks Report 21 years ago, the economic levers deployed by major powers to reshape global trade interactions surpass all other immediate risks, even armed conflicts. 18% of the 1,300 experts surveyed across 116 countries identify this confrontation as the risk most likely to trigger a material crisis at a global scale this year.

The Five Risks Triggered by Geoeconomic Confrontation

According to the Global Risks Report 2026 interconnection map:

Critical infrastructure disruptions — Vulnerability of export corridors

Systemic supply chain disruptions — Direct impact on global mining logistics

Economic recession — Slowdown in demand for industrial minerals

Natural resource shortages — Race for strategic reserves

Armed conflicts between states — Escalation of geopolitical tensions

From Trade Wars to Mineral Weaponization

“We are witnessing a paradigm shift,” the report states, documenting how sanctions, tariffs, and investment controls are no longer mere commercial tools but “geopolitical influence weapons” aimed at “consolidating spheres of influence” and “constraining geopolitical rivals.”

The numbers speak for themselves: according to data from the Executive Opinion Survey included in the report, 16 economies, including several major mineral exporters, rank geoeconomic confrontation among their top five national risks for the next two years. This list includes critical actors in the global mining supply chain.

Countries not aligned with China or the United States may face pressure to comply with sanction regimes.

The 2026 Global Risks Report

For Africa, a continent holding 30% of the world’s mineral reserves, the equation is more complex. A reality well known to cobalt producers in the Democratic Republic of the Congo and platinum miners in South Africa.

The Silent Escalation

Our analysis highlights a worrying escalation: geoeconomic confrontation goes far beyond traditional tariffs. Governments are losing faith in the legal framework of global trade, the number of disputes brought before the World Trade Organization (WTO) has fallen to a third of its pre-2019 level, the year its Appellate Body was paralyzed.

At the same time, investment screening policies are multiplying among G20 countries, “more driven by strategic realignment and national security considerations than in previous years,” the report notes. The number of sectors considered “strategic” for national security and targeted by sanctions, export controls and investment bans, is continuously increasing.

Rare earths, lithium, cobalt, graphite, all these minerals essential to the energy transition are now on the list. In October 2024, China imposed export controls on antimony, a critical metal for batteries and semiconductors. In response, the United States expanded its restrictions on quantum technologies and artificial intelligence.

Fragmentation of Supply Chains

The implications for the mining industry are considerable. The report draws a direct link between geoeconomic confrontation and “systemic supply chain disruptions”, a risk that rises to 19th globally.

Data from the Executive Opinion Survey reveal that economies ranking geoeconomic confrontation as a major risk also report high concern over supply chain disruptions. This correlation is no coincidence: it reflects the operational reality of mining companies forced to rethink decades of logistical optimization.

“In a worst-case scenario, a more intense decoupling between Eastern and Western blocs would have profoundly negative implications for global economic growth,” the report warns. Partial decoupling, in trade, investment, finance, and technology ecosystems could significantly increase costs for companies and slow global economic activity.

Africa, an Unwilling Arbiter

For African countries attending Mining Indaba, the question is no longer theoretical. Should they prioritize partnerships with China, which has invested USD 170 billion on the continent since 2000, or align with Western initiatives such as the Global Infrastructure and Investment Partnership (GIIP)?

Countries not aligned with either camp may face the risk of failing to find a new balance, particularly vulnerable if pressures intensify to comply with various sanction regimes. This balancing act becomes even more perilous as the report documents an unprecedented “retreat of multilateralism.” 68% of respondents anticipate “a multipolar or fragmented order in which medium and large powers contest, establish, and enforce regional rules and norms” over the next ten years. Only 6% foresee a revitalization of a U.S.-led international order.

Beyond Trade: Militarization of Infrastructure

This is an emergence of new frontiers in geoeconomic confrontation. Access to capital and control of capital flows could become “a new front,” with governments potentially adopting “more aggressive policies to shape the global monetary system to their advantage.”

Even more worrying: “physical disruptions to critical infrastructure and key supply chains”, damaged undersea communication cables, blocked maritime routes, sabotaged energy pipelines, could become cyber-physical tools used more frequently.

For the mining sector, highly dependent on logistical corridors, ports, railways, roads, this potential militarization of infrastructure represents an existential risk. Disruptions to the Suez Canal and strategic straits as precursors of what could become a normalized geopolitical tactic.

Accumulation of Strategic Reserves

Faced with these threats, more governments are likely to seek to protect their economies by building larger reserves of energy products and key manufacturing inputs, and by stockpiling food, metals, and minerals. This race for strategic reserves could “trigger price spikes and place intense trade, diplomatic, and even military pressures on governments of countries where these raw materials can be extracted. Resource-rich regions, including Sub-Saharan Africa, risk becoming arenas of “direct and indirect pressures from major powers or conflicts between global powers.

The Cost of Inaction

The risk maps clearly position geoeconomic confrontation as a trigger for multiple interconnected risks: supply chain disruptions, economic recession, concentration of strategic resources, armed conflicts between states, and critical infrastructure disruptions.

For the 10,500 participants expected at Mining Indaba, corporate leaders, ministers, investors, the challenge goes beyond simple risk management. It is about fundamentally rethinking operational models in a world where market logic is gradually giving way to realpolitik.

“In a world already weakened by growing rivalries, unstable supply chains, and prolonged conflicts with potential regional spillovers, such confrontation carries systemic, deliberate, and far-reaching global consequences,” the report concludes unequivocally.